Itemizing deductions bumps the average fee by more than 100 to 294. They estimate the average cost for professional tax preparation as ranging between 152 to 261 depending upon the complexity of your taxes and whether you have additional forms beyond the 1040 to prepare.

Big Jumps Seen In Tax Prep Fees Survey Accounting Today

Big Jumps Seen In Tax Prep Fees Survey Accounting Today

Individual Income Tax Return.

Average tax prep fees. Average Tax Preparation Fees According to a 2019 survey the National Society of Accountants says that you should expect to pay an average of 294 if you itemize your deductions on your tax return. Other Factors That Determine Your Tax Preparation Fees As mentioned earlier on average itll cost you 176 for a standard 1040 Form and state return. 10 Zeilen Of course your tax preparation fees will also vary based on what type of forms you will be.

East South Central Alabama Kentucky Mississippi Tennessee. They can inform you of the tax-saving strategies unique. 4 Zeilen The average cost for a Tax Preparer is 190.

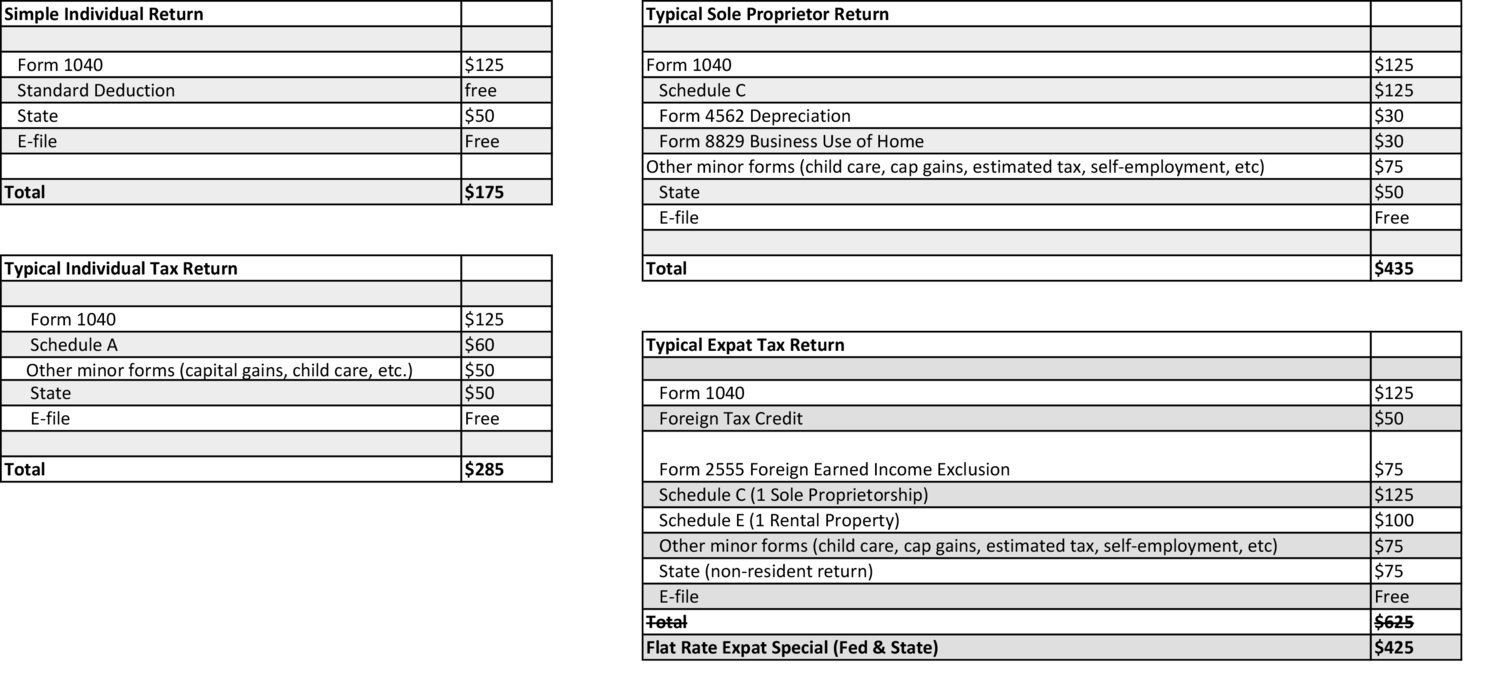

Before you gulp you can take some comfort in knowing that this generally includes both your state and federal returns. Our primary focus is business consultation deduction optimization and tax return preparation. The average hourly fee for representing a taxpayer at an IRS in-person or field audit is 150.

Typical fee range is 1000 to 1200 for partnership and corporate tax returns depending on the quality of your accounting records. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions along with a state income tax return was a flat. The tax preparation becomes complex in the case of multiple incomes which means an individual has more than one as a source of income.

Hiring a tax accountant to file your taxes you will likely spend between 99 and 450 per return. The next tax preparation that we do is a null corporate tax return and the charge is 350. To hire a Tax Preparer to prepare your taxes.

While this is the average dont assume that it is set in stone. You may consider higher or lower fees depending on factors such as form complexity your costs of doing business your pricing strategy and whether you offer the added value of year-round services. The fees range from 100 to 1500.

But dont run off with that number just yet. View our local tax accountants or get free estimates from pros near you. 1 That fee covers a standard 1040 and state return with no itemized deductions.

The last is corporate tax filing in which the tax preparation fees range between 800 2500. While the national average is a good starting place a lot of things determine the actual cost. These are the average tax preparation cost for an itemized 1040 form with Schedule A and a state return in each region.

Tax prep pros can also offer other services. 210 West North Central Iowa Kansas Minnesota Missouri Nebraska North Dakota South Dakota. Please note all businessfiduciary return fees are based on a national average instead of your demographics.

The average cost for tax preparation is 225 per return. Reported national averages for tax prep fees for businesses included 755 for an 1120 721 for an 1120-S and 682 for a 1065 Canopy said. The average fee charged to prepare an itemized Form 1040 with Schedule A and a state tax return is 273 and the cost for a Form 1040 without itemized deductions and a state return is 176.

According to the National Society of Accountants NSA the average tax prep costs by form range from 63 for a federal unemployment IRS Form 940 and 806 for a. The average cost for a basic tax form preparation is about 176. The price of tax preparation can vary greatly by region and even by zip code.

According to the National Society of Accountants 20182019 Income and Fees Survey the average tax preparation fee for a tax professional to prepare a Form 1040 and state return with no itemized deductions is 188.