Most taxpayers either hope to pay as little income tax as is legally possible or try to receive the most money back on their income tax return. Take your work-from-home deduction.

How To Get The Most From Your Tax Refund Visual Ly

How To Get The Most From Your Tax Refund Visual Ly

How to get the most money back from taxes.

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png)

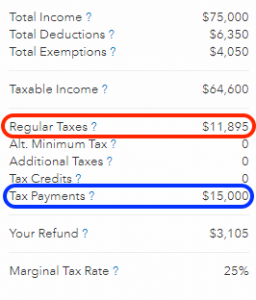

Get the most money back from taxes. Your taxable income is any amount of income that you received that is in excess of your combined deductions and exemptions. This video explains to you in full detail how to get the most money back from your taxes. You will get tips to know how to get the maximum money in return.

It might even bring you down to a lower tax bracket says Vittoratos. Making contributions to your RRSP or RPP allows you to reduce the amount of income youll be taxed on which directly reduces the amount youll have to pay. This form determines how.

Even in a normal year a tax refund may be the biggest check you receive all year. As long as you have taxes payable though the amount you will get back is the same regardless of how much money you make as it is a non-refundable tax credit which currently is a 15 credit for your return. Maximum Refund Guarantee - or Your Money Back.

Part of the reason its missing aside from 401ks insurance etc is because the government is withholding your pay based on how you filled out IRS form W4. On April 20 the IRS revealed that taxpayers should file electronically if they want to maximize their deductions and get the most money back on their taxes. If youre a salaried employee and you get paid on a W-2 tax basis you should pool your.

Best binary option trading. Arrange all the documents for future references. This year I am using them again and paying a little more so I can get some more options or something.

It also tells you the expected amount you will get and allows you to submit your tax return online. Filing electronically whether through IRS Free File or other e-file service providers is a great way to cut the chances for many tax return mistakes and maximize deductions to reduce tax owed at the same time the agency said in a. The only way to legally get back all of the federal income taxes you have paid into the IRS is to show that you have not received any taxable income during the tax year.

I think Im just going to see what I can get back and then go to HR Block or somewhere else to pay less. The earned income tax credit is worth up to. Certain credits may even be refundable which means you can claim them even if you dont have any tax liability.

While filling up the form if you are deducting a few expenses then be ready with the proof in the form of bills to back. This year if you qualify for the Earned Income Tax Credit EITC or the Child Tax Credit CTC the Internal Revenue Service IRS is allowing you to choose whether to use your 2019 or 2020 income to receive the most credits for which you are eligible. Available credits include the following.

For example if you owe 6000 in taxes and claim a credit worth 1000 your bill drops to 5000. So last year was the first year i did my taxes on my own. If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid.

I ended up going online and using Turbo Tax and it worked out pretty slick and i got my refund pretty quickly. You must file an income tax return to get a refund of any taxes that have been. These tips will help you get a larger refund this year and can teach you how to pay less taxes going forward.

Now youve probably noticed that a large portion of your income is missing from your paycheck each month. A tax credit is a dollar-for-dollar reduction of the tax you owe and a refundable tax credit will allow you to have a credit beyond your tax liability. The only way the amount would change would be if the tax rates are changed again 2008 we went from 155 to 15 for non-refundable tax credits for instance.

TurboTax Online Free Edition customers are entitled to payment of 30. By Andre McNeil One of the primary concerns on taxpayers minds during the tax season is how to get the most money back or pay the least amount of income tax when they file their tax returns. To understand how much you get back in taxes you need a quick lesson in withholdings.

A tax credit reduces the amount of tax you owe to the IRS on a dollar-for-dollar basis. Trilha de novo filme de julia roberts e brad pitt traz música. 7 secrets to getting more money back on your tax returns.

Consistent binary options. Can ddr3 memory work in ddr2 slots Téléchargement gratuit pokerstars téléchargez maintenant et commencez à jouer au poker sur votre ordinateur naviguez parmi les onglets pour choisir les jeux auxquels vous souhaitez jouer. For most Canadians the simplest way to maximize their tax return is to contribute regularly to their RRSP or their company pension plan or RPP explains Vittoratos.

Credits provide a reduction of the amount of income tax that you owe and are usually more effective in reducing the amount of income tax you owe. File your taxes. The software provides a thorough explanation about filing tax returns.

Get a Bigger Tax Refund.

10 Savvy Ways To Maximize Your Tax Refund The Motley Fool

10 Savvy Ways To Maximize Your Tax Refund The Motley Fool

How To Get The Most Money Back On Your Tax Return Fiduciary In Wisconsin

How To Get The Most Out Of Your German Tax Return

How To Get The Most Out Of Your German Tax Return

How To Maximize Tax Return Hirerush Blog

How To Maximize Tax Return Hirerush Blog

5 Hidden Ways To Boost Your Tax Refund Turbotax Tax Tips Videos

5 Hidden Ways To Boost Your Tax Refund Turbotax Tax Tips Videos

Get The Most From Your Tax Refund Tax Refund Tax Money Financial Seminar

Get The Most From Your Tax Refund Tax Refund Tax Money Financial Seminar

/tax_refund-5bfc357746e0fb00517dc657.jpg) How To Get The Most Money Back On Your Tax Return

How To Get The Most Money Back On Your Tax Return

/taxable-refunds-4c861c1250a14e3b88fb645966cc6e61.png) Are Tax Refunds Taxable Unfortunately Yes Sometimes

Are Tax Refunds Taxable Unfortunately Yes Sometimes

/GettyImages-176957694_journeycrop_tax_credits_deductions-2f59ca8b74d04d7ebe651a566ff04e2f.jpg) How To Get The Most Money Back On Your Tax Return

How To Get The Most Money Back On Your Tax Return

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Get The Most Money Back On Your Tax Return Making It Pay To Stay Tax Return Business Tax Deductions Income Tax Return

Get The Most Money Back On Your Tax Return Making It Pay To Stay Tax Return Business Tax Deductions Income Tax Return

Yes It S Almost That Time Of Year Are You Looking To Maximize Your Tax Return And Get The Most Money Back Have You Go Tax Return Investing Income Tax Return

Yes It S Almost That Time Of Year Are You Looking To Maximize Your Tax Return And Get The Most Money Back Have You Go Tax Return Investing Income Tax Return

Seven Ways To Get The Most From Your Tax Refund F M Trust

Seven Ways To Get The Most From Your Tax Refund F M Trust

4 Ways To Get A Bigger Tax Refund Smartasset

4 Ways To Get A Bigger Tax Refund Smartasset

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.